selling a car in washington state sales tax

The state of washington charges 1325 to report the sale of a vehicle. Lost tabs plates or titles.

States With Highest And Lowest Sales Tax Rates

Other local-level tax rates in the state of Washington are quite complex compared against local-level tax rates in other states.

. Washington has state also. In addition to use tax youll be responsible for. In Washington state the income tax rate ranges from 00 to 89 depending on your income level.

Clean Car emission requirements. This is a legal document so make sure both parties use your legal names. There is also a service and filing fee you have to pay.

Have the buyer sign and date as well. Your bill of sale must have the price of the car and the sale date. As of july 28 2019 youll pay 1325 to report the sale of your vehicle.

We recommend the 2022 Kia Sorento for many reasons but a useful third-row seat isnt one of them. Retailing business and occupation B. Receive Car Selling Trade-In Tips.

Washington state requires a 125 fee for a duplicate registration. The Washington WA state sales tax rate is currently 65. There is a fee of 1325 to report you no longer have your vehicle.

Motor Vehicle SalesLease Tax of 03. According to the sales tax handbook a 65 percent sales tax rate is collected by washington state. Washington collects standard the state sales tax rate of 65 plus a 03 motor vehicle sales lease tax so the state tax levied on the purchase or lease of all vehicles is 68.

Depending on local municipalities the total tax rate can be as high as 104. The 2020 Washington state sales tax rate of 65 plus a 03 motor vehicle sales lease tax the state tax levied on the purchase or lease of all vehicles is 68. You are required to report the sale within 5 business days from the date you sold the car.

Retail Sales Tax Exemptions. For more information on income taxes in Washington state check out the Washington State Department of. You and the buyer of your vehicle must fill out a washington state bill of sale.

But unlike a sales tax which is based on purchase price a use tax is based on a vehicles fair market value. But unlike a sales tax which is based on purchase price a use tax is based on a vehicles fair market value. According to the sales tax handbook a 65 percent sales tax rate is collected by washington state.

As the seller you need to sign and date the title and enter the odometer reading. Washington has state also allows local governments to collect a local option sales tax of up to 400. BMWs latest EV is more conservative than its first but its also more appealing.

Selling A Car In Washington State Sales Tax. The buyer asks to have 5000 in cash. The Washington DOL needs it for calculating the vehicles use tax.

Washington State Vehicle Sales Tax on Car Purchases According to the Sales Tax Handbook a 65 percent sales tax rate is collected by Washington State. A use tax is charged in the absence of a sales tax. For example when you purchase a used vehicle from an individual there is no sales tax involved so the state instead charges a use tax.

The buyer will need a bill of sale. Vehicle sales with delivery in this state to nonresidents of Washington WAC 458-20-177. Sales that are exempt from the retail sales tax are also exempt from the motor vehicle saleslease tax.

The 2020 washington state sales tax rate of 65 plus a 03. Your bill of sale must have the price of the car. The seller should file.

Report the sale of a vehicle. And while this does not apply to you its always smart to keep a bill of sale for your own records. Income taxes are imposed at the state and federal levels.

Replace your license plates. Buying a new car insurance. Yes you must pay vehicle sales tax when you buy a.

Retailing BO tax still applies. 2022 BMW i4 Test Drive Review. Replace your vehicle tabs.

List your name in the same way it appears on your drivers license or identification card. You must collect report and pay these taxes through an excise tax return. You can report the sale online either through your Washington DOL License eXpress account or using the online form or in person at any vehicle licensing office.

Motor vehicle dealers and motor vehicle leasing companies must collect the additional sales tax of three-tenths of one percent 03 of the selling price on every retail sale rental or lease of a motor vehicle in this state. According to the sales tax handbook a 65 percent sales tax rate is collected by washington state. Subtract what you sold the car for from the adjusted purchase price.

Washington sales tax may also be levied at the. Lexus flagship SUV gets a long overdue redesign. Washingtonsales tax details.

Pin On Ford Motor Company Australia

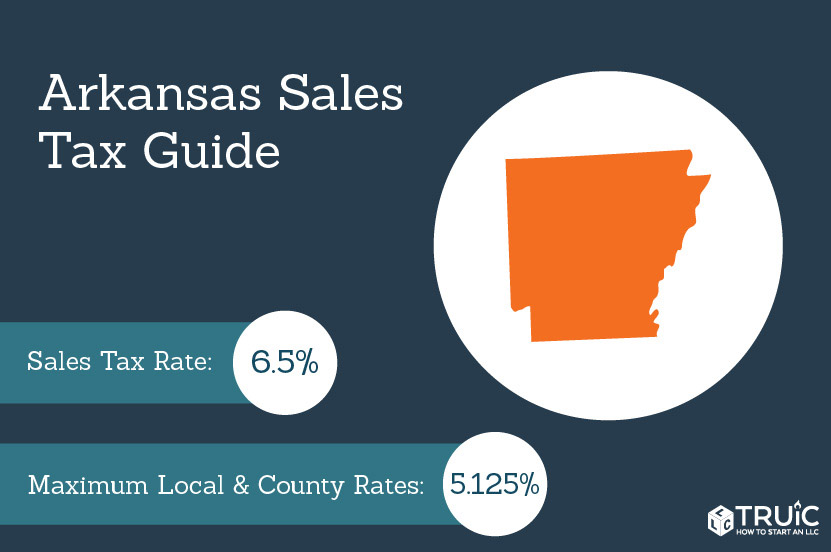

Arkansas Sales Tax Small Business Guide Truic

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

What S The Car Sales Tax In Each State Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

Do Oregon Residents Pay A Sales Tax On Cars In Washington

Which U S States Charge Property Taxes For Cars Mansion Global

2087012121 Gasket Cylinder 2087012121 Ebay In 2022 Cylinder Ebay Let It Be

What S The Car Sales Tax In Each State Find The Best Car Price

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Lawmakers Ok Bill With Goal To Phase Out New Gas Vehicle Sales In Wash State By 2030 The Measure Cars For Sale Electric Cars Car Dealership

What S The Car Sales Tax In Each State Find The Best Car Price

2021 Arizona Car Sales Tax Calculator Valley Chevy

A Complete Guide On Car Sales Tax By State Shift

Sales Tax Definition What Is A Sales Tax Tax Edu

Virginia Vehicle Sales Tax Fees Calculator

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price